1. Decentralization

1.3. Gregory Maxwell On decetralization

I think questions like this are ultimately the result of a fundamental lack of understanding about what Bitcoin is doing.

The problem Bitcoin is attempting to solve is getting everyone everywhere to agree on the same stable history of transactions. This is necessary because in order to prevent users from printing money from nothing the system must have a rule that you can’t spend a given coin more than once-- like I have a dollar then pay both alice and bob that dollar, creating a dollar out of nothing.

The intuitive way to prevent that excessive spending is to decide that first transaction that spends a coin is valid and any additional spends are invalid. However, in a truly decentralized system "first" is actually logically meaningless! As an inescapable result of relativity the order which different parties will perceive events depends on their relative positions, no matter how good or fast your communication system is.

So any system that needs to prevent duplication has to have a way to artificially assign "firstness". Centralized systems like ripple, eos, iota, blockstream liquid, etc. just have a single party (or a virtual single party) use its idea of whatever came first and everyone else just has to accept its decision.

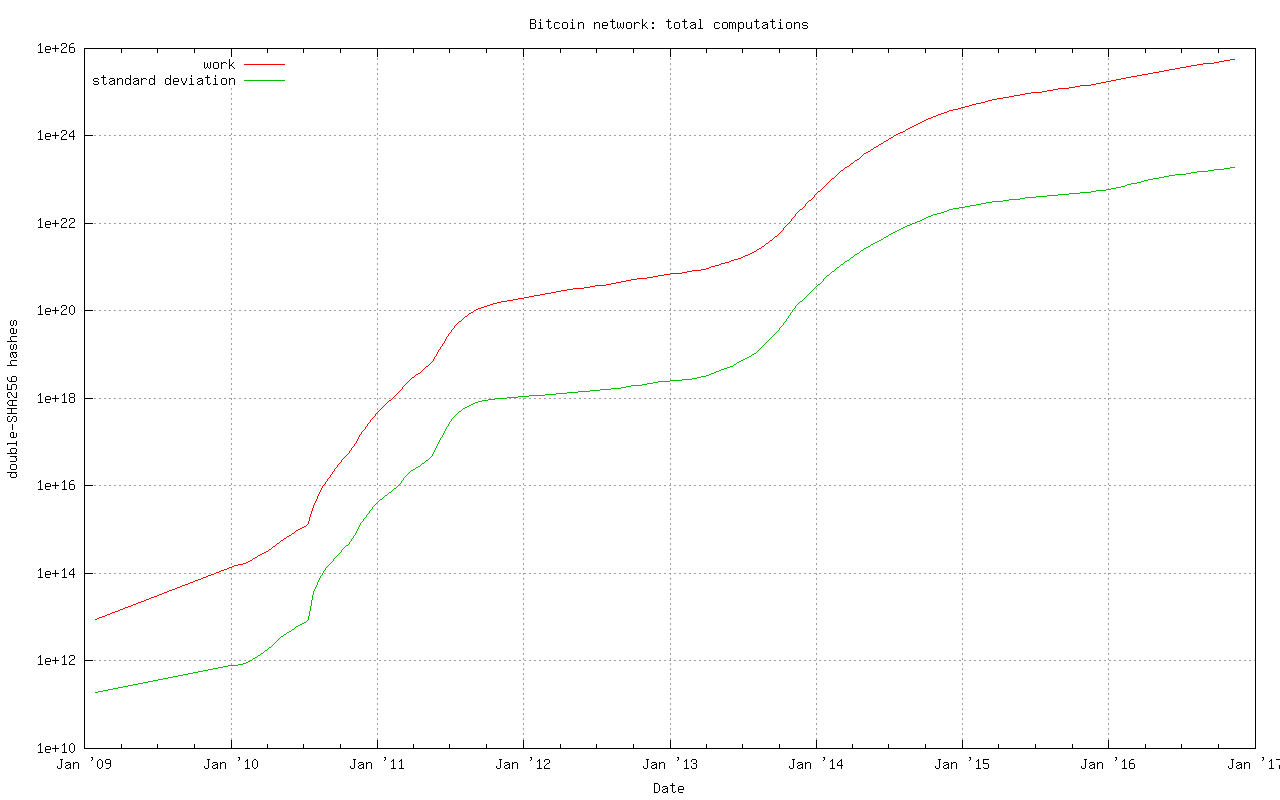

A decentralized system like Bitcoin uses a public election. But you can’t just have a vote of 'people' in a decentralized system because that would require a centralized party to authorize people to vote. Instead, Bitcoin uses a vote of computing power because it’s possible to verify computing power without the help of any centralized third party.

If we didn’t have the constraint that this system needed to work online, then you could imagine an alternative where consensus could be determined by people presenting large amounts of some rare element. … but you can’t prove you control osmium online, it appears that computing power is the only thing that can work for this purpose online.

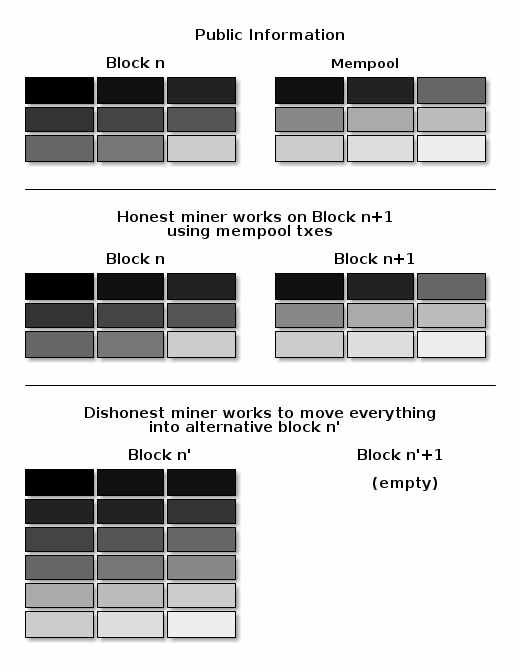

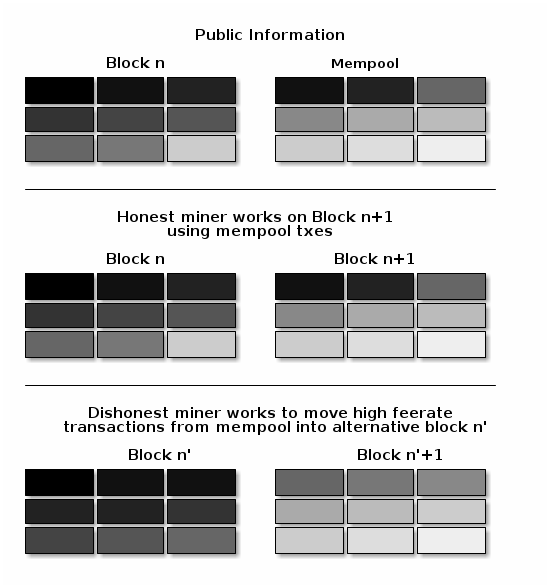

When people talk about "51%" all they’re really talking about is people rigging that election, so that they can override what everyone previously thought was the accepted order of transactions with a new order that changes some of their payments from one party to another.

With this understanding maybe you can see that the concern doesn’t even depend on a single person having too much of the hash-power. The attack would work just as well if there were 100 people each with an equal amount and a majority of them colluded to dishonestly override the result.

Also, any mechanism that would let you prevent one party (much less a secret collusion) from having too much authority would almost certainly let you just replace mining entirely. The only known way to do that is to introduce centralization and if you’re willing to do that it’s trivial, if you’re not it appears impossible. People have cooked up 1001 complicated schemes that claim to do it without introducing centralization, but careful analysis finds again and again that these fixes centralize the system but just hide the centralization.

I think people obsess far too much about "51%"-- it has some kind of attractive mystery to it that distracts people. If you’re worried that someone might reorder history using a high hash-power collusion-- just wait longer before you consider your transactions final.

A far bigger risk to Bitcoin is that the public using it won’t understand, won’t care, and won’t protect the decentralization properties that make it valuable over centralized alternatives in the first place. … a risk we can see playing out constantly in the billion dollar market caps of totally centralized systems. The ability demonstrated by system with fake decentralization to arbitrarily change the rules out from under users is far more concerning than the risk that an expensive attack could allow some theft in the case of over-eagerly finalized transactions.

1.4. The decentralist perspective, or why Bitcoin might need small blocks

AARON VAN WIRDUM SEP 12, 2015

Op-ed - The Decentralist Perspective

The block-size limit debate has dominated Bitcoin blogs, forums, chat rooms and meet-ups for months on end, while many of Bitcoin’s brightest minds are gathering in Montreal to discuss the issue face-to-face at the Scaling Bitcoin Workshop this weekend.

So far, however, the two sides of the debate have made little progress coming to a consensus. At least for some part, this seems to result from a difference of visions – visions that are based on a different set of priorities.

One of these visions – represented by Bitcoin XT developers Gavin Andresen and Mike Hearn – is straightforward and clear. For Bitcoin to succeed, they believe it needs to grow, preferably fast. And for Bitcoin to grow fast, it needs to be cheap, accessible and easy to use. This, in turn, means that the block-size limit needs to increase in order for more transactions to fit on Bitcoin’s blockchain, for fees to remain low, and without having to rely on complicated and far-off alternative solutions. This could mean that some aspects of the Bitcoin ecosystem need to specialize further, but that was always to be expected.

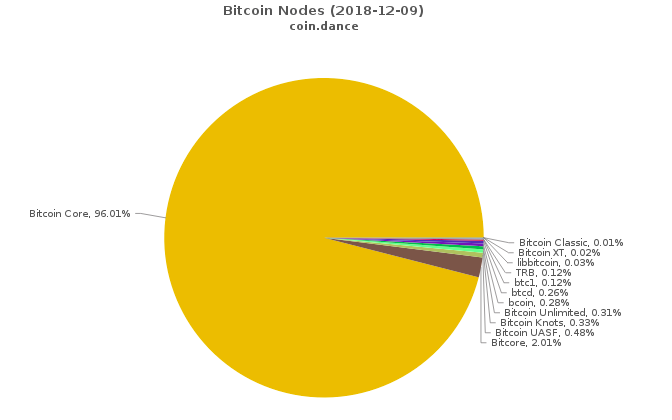

On the other end of the spectrum, a majority of Bitcoin’s most active developers think it’s not that simple. For them, Bitcoin’s decentralized nature is sacrosanct, and they believe that an increase of the block-size limit represents a trade-off with this core feature. Some of these developers – perhaps best described as Bitcoin’s “decentralists” – even warn that too big an increase could destroy the system as a whole.

But for many outside this select group developers it still seems unclear why, exactly, big blocks could pose such a grave threat. To find out, Bitcoin Magazinespoke with four of the most prominent of these decentralists: Bitcoin Core developer Dr. Pieter Wuille, Bitcoin Core developer and long-term block-size conservative Peter Todd, hashcash inventor and Blockstream founder and president Dr. Adam Back, and well-known cryptographer and digital currency veteran Nick Szabo.

MINING CENTRALIZATION

According to decentralists, the problem of big blocks is essentially twofold. On one hand there is the basic assumption that bigger blocks favor bigger miners – presumably mining pools. On the other hand is the fact that bigger blocks complicate mining anonymously.

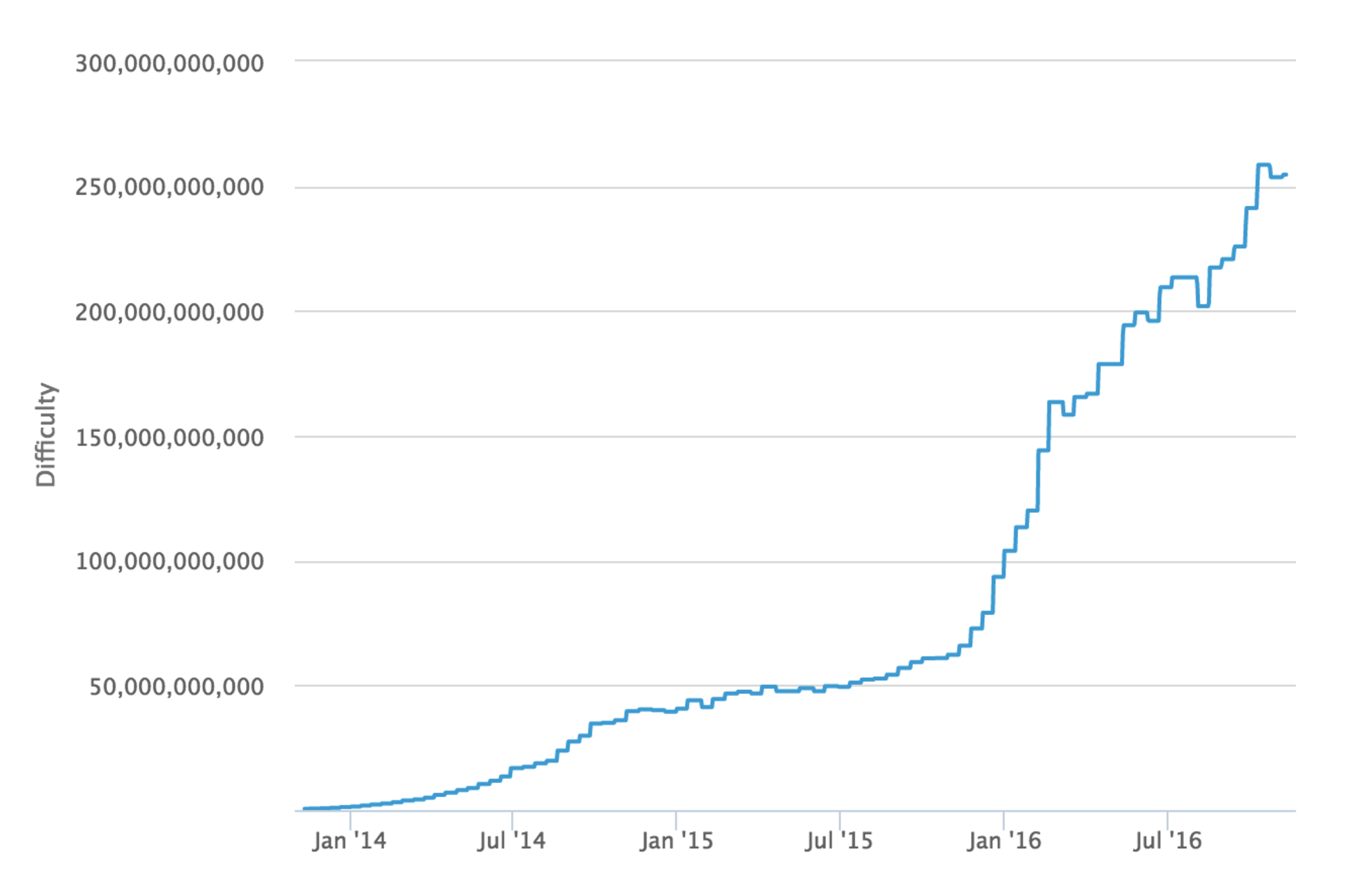

The main (though not only) reason bigger blocks favor bigger miners has to do with latency. As the block size increases, so does the time it takes for a newfound block to transmit through the Bitcoin network. That is disadvantageous to all miners, except for the miner that found the block. During the time it takes a new block to make its way through the network, the miner who found the block gets a head start mining on top of the new block, while other miners are still busy mining on top of an older block. So as a miner find more blocks, it gets more head starts. And as a miner gets more head starts, it finds more blocks. Meanwhile on the other end of the equation, smaller miners find fewer blocks and, as a result, have more trouble turning a profit, ultimately causing them to drop off the network. Bigger blocks tend to centralize mining.

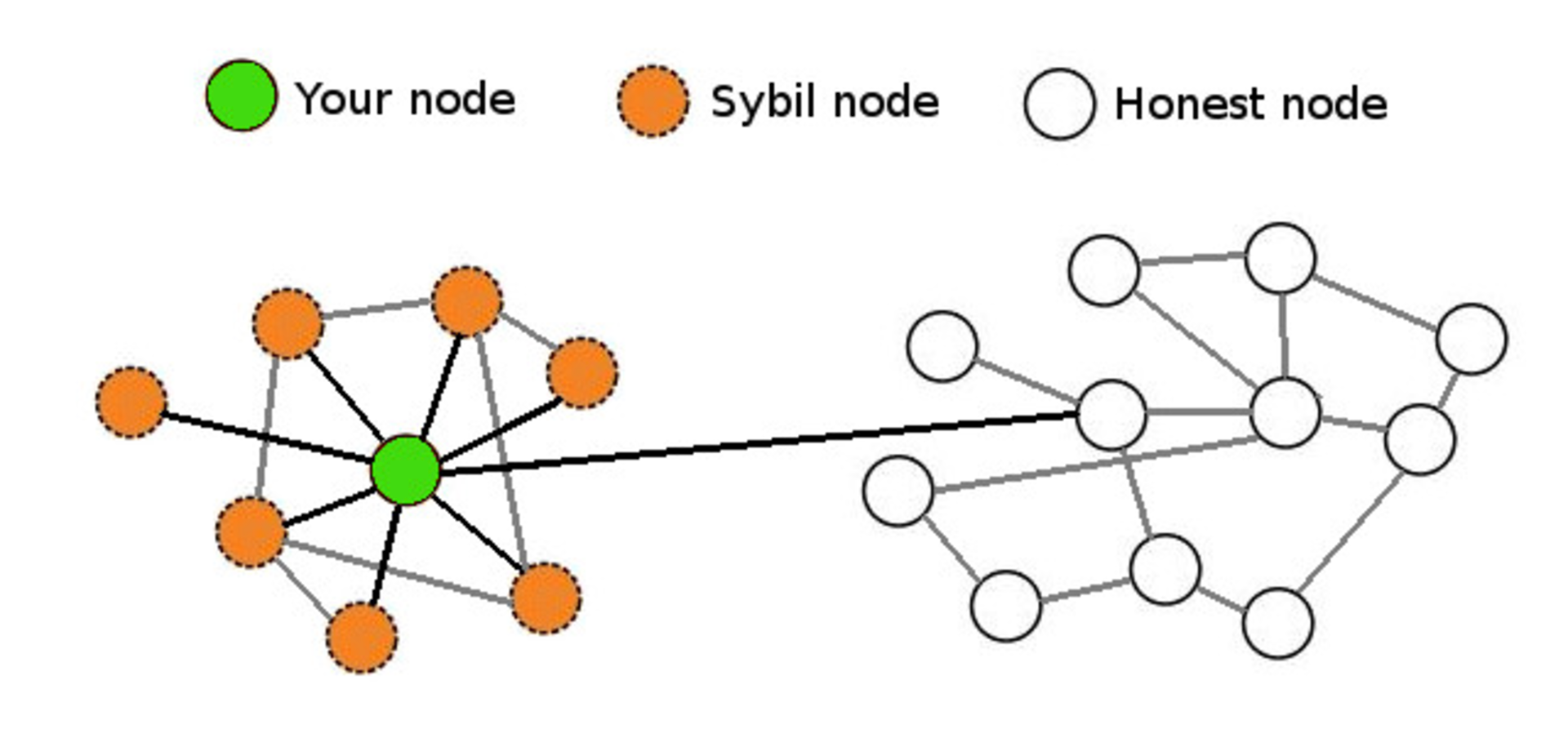

This problem is worsened, moreover, if a miner wishes to remain anonymous, and wants to use Tor. Since latency on the Tor network is always higher, the problem as described above is simply magnified. If smaller miners are disadvantaged by bigger blocks to the point where it’s hard to remain profitable on a regular connection, miners using Tor don’t even stand a chance.

Neither of these arguments against bigger blocks is controversial in itself. The controversy lies in the question how big is too big. Andresen and Hearn believe an increase to 8 megabytes or even 20 megabytes should be OK, and assume that it’s fine to grow this limit to 8 gigabytes over a 20-year time period.

Speaking to Bitcoin Magazine, Bitcoin Core developer and Blockstream co-founder Dr. Pieter Wuille explained why this assumption is not shared by decentralists.

“It is obvious that block propagation is too slow already,” Wuille said. “A recent software update revealed that several mining pools maintain arrangements where they share block headers – the minimal required part of an actual block – the moment they find a new block. All miners in on the deal then start mining on top of that block header instead of waiting for the full block to propagate over the network – waiting would cut into their profits too much.”

Explaining why this is a problem, Wuille continued:

“This practice is harmful for Bitcoin, as it requires a lot of trust among miners. They no longer verify the validity of blocks individually, and instead just rely on their peers. But validating blocks is supposed to be a miner’s main task on the Bitcoin network…”

Moreover, decentralists warn there might be no turning back once bitcoin mining has become too centralized. At that point, the remaining miners could have created a deadlock on the mining market, essentially preventing newcomers to compete profitably.

Core developer and long-time block-size conservative Peter Todd told Bitcoin Magazine:

“The big concern we have here is, as we reduce these security margins, we’ll see the already worryingly small number of pools decrease even further. Even more concerning though, is that while currently it’s pretty easy to start a new pool if an existing one ‘goes rogue,’ bigger blocks can make it much more difficult to do so, because from the beginning you’ll be much less profitable than the big pools.”

And while it has been suggested that miners can connect to a VPS if they prefer to remain anonymous rather than connect through Tor, this is not quite satisfying for decentralists either. Speaking to Bitcoin Magazine, hashcash inventor and Blockstream CEO Dr. Adam Back explained why.

“It is technically possible to mine using a VPS (Virtual Private Server), but miners who do so are not choosing their own transactions,” Back emphasized. “Instead, they connect to a server that does this for them. It’s another form of centralization, at the extreme. And we already see this happening due to bad connectivity in some countries, where miners use VPS services set up in another country to win some time and increase profits…”

REGULATION

Decentralization – and anonymity – might be sacrosanct for decentralists, but that does not mean they are goals in and of themselves. Instead, decentralists cling to these properties because they believe the health of the Bitcoin network relies on them. It’s only through decentralization and anonymity that the system can remain free from outside influence, such as government regulation.

“Bitcoin achieves policy neutrality by decentralization of mining,” Back explained. “If one miner won’t mine your transaction, another will. It’s an additional benefit if miners are many, geographically dispersed and anonymous, since it’s complex to coordinate a policy imposition on many small geographically dispersed miners. And it’s even more complex to impose policy on someone who is anonymous.”

If, on the other hand, Bitcoin reaches the point where only a handful of professional miners will be able to profitably partake in the process of Bitcoin mining, and if these miners are no longer able to do so anonymously, decentralists worry that Bitcoin’s fundamental properties might be at risk.

“It is pretty clear that forcing the Bitcoin protocol to implement anti-money laundering policy and blacklisting of funds is a long-term goal of governments, which can be done by pressuring mining pools,” Todd explained. “Being able to tell regulators that pressure will simply cause pools to leave regulated jurisdictions is important, but without anonymity, there really aren’t that many jurisdictions to run to.”

Furthermore, once more that half of all hashing power is effectively regulated, authorities could even demand a complete freeze of certain funds, Back explained:

“If more than 50 percent of mining is subject to policy, it can actually censor any transaction by ignoring – orphaning – blocks made by other miners. We don’t know if that would happen or not, but given the fact that it would be within their technical power to do it, it should be expected that regulators demand their regulations achieve an effect.”

Moreover, once this sort of regulation does set in, decentralists believe it will probably be too late to fix. Bitcoin would be caught in a regulatory trap without even noticing it – until the trap closed.

Back continued:

“If Bitcoin is already at high policy risk – sort of effectively centralized but not experiencing the side-effects of that yet – and then the policy problem arises, the properties of Bitcoin are lost or eroded. How can you fix it at that point? Suddenly decentralize it? It’s uncertain that the parties who are at that point under central control over the Bitcoin network have the free choice to work to decentralize it. They would have been regulatory captured.”

FULL-NODE CENTRALIZATION

But even mining centralization and regulation might not be the end of it, decentralists warn. Ultimately, over-sized blocks bear with it another – perhaps even bigger – risk: full-node centralization.

Full-node centralization could be an even bigger risk than mining centralization, decentralists argue, as full nodes effectively verify the consensus rules Bitcoin plays by. These consensus rules enforce that Bitcoin has a 1MB block-size limit, but also that the block reward halves every four years, or that the total supply of bitcoin will not exceed 21 million. And – importantly – being able to verify these rules is what makes Bitcoin a trustless solution. In essence, full nodes allow users to check that Bitcoin does as promised.

But as it becomes expensive to run a full node, decentralists worry that verifying the consensus rules could become reserved to a small elite. This could have several consequences.

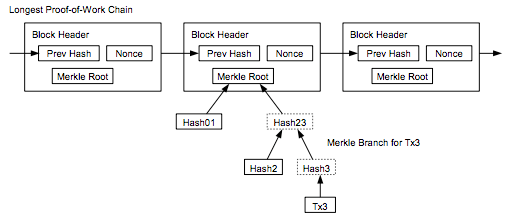

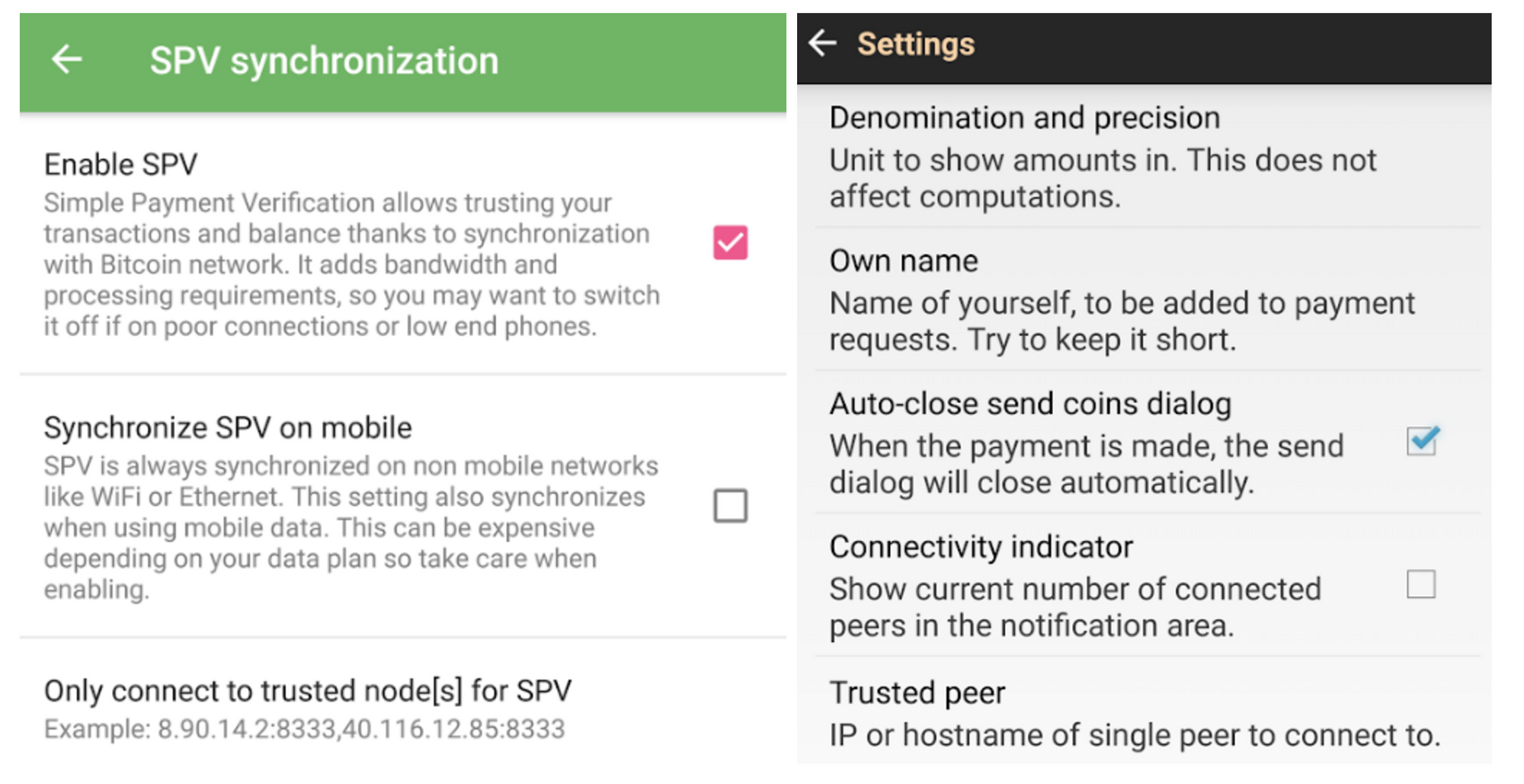

An obvious consequence would be that it injects trust in the system. Instead of using trustless full nodes, users would, for instance, use web-wallets – which obviously require a lot of trust in the service. But even solutions such as Simplified Payments Verification (SPV) nodes are no better in this regard, as they do not verify the consensus rules either.

Peter Todd explained:

“SPV nodes and wallets are not a trustless solution. They explicitly trust miners, and do no verification of the protocol rules at all. For instance, from the perspective of an SPV node there is no such thing as inflation schedule or a 21 million bitcoin cap; miners are free to create bitcoins out of thin air if they want to.”

And while the cheating of SPV nodes could be seen as a short-term problem, some decentralists argue that a drop in full nodes might even have more severe consequences in the longer term.

According to Wuille:

“If lots companies run a full node, it means they all need to be convinced to implement a different rule set. In other words: the decentralization of block validation is what gives consensus rules their weight. But if full node count would drop very low, for instance because everyone uses the same web-wallets, exchanges and SPV or mobile wallets, regulation could become a reality. And if authorities can regulate the consensus rules, it means they can change anything that makes Bitcoin Bitcoin. Even the 21 million bitcoin limit.”

It is of vital importance for the health of the Bitcoin network, therefore, that it remains possible to run full node anonymously, Todd urged:

“Like mining, having the option to run full nodes totally ‘underground’ helps change the discussion and gives us a lot of leverage with governments: try to ban us and you’ll have even less control. But if we don’t have that option, it starts looking like regulation efforts have a decent chance of actually working, and gives governments incentives to attempt them.”

Commenting on the block size limit debate itself, Back added:

“I believe that the unstated different assumption – the point at which views diverge – is the importance of economically dependent full nodes. It seems that Gavin thinks a world where economically dependent full nodes retreat to data-centers and commercial operation – and basically all users can only get SPV security – is an OK trade-off and cost of getting to higher transaction volume a year early. But most of Bitcoin’s technical experts strongly disagree and say this risks exposing Bitcoin to erosion of its main differentiating features.”

TRADE-OFFS

So what if decentralists are right? Bitcoin mining, and perhaps even running a full node, is reserved to specialists working from data centers. Anti-Money Laundering and Know Your Customer policy might be imposed, and perhaps the protocol rules are regulated to a certain extent. Sure, it would be a blow for drug dealers, CryptoLocker distributors and extortionists, but Bitcoin would still be a global, instant and cheap payments system. In a way, Bitcoin might actually be better of without these outlaws. Right?

Well, not according to decentralists.

Most decentralists maintain that Bitcoin’s distinguishing features are not its global reach, its instant transactions, or its low costs of use. Instead, they argue, Bitcoin’s single most important distinguishing feature is its decentralized nature. Without it, there would be no reason for Bitcoin to even exist.

Well-known cryptographer and digital currency veteran Nick Szabo explained:

“In computer science there are fundamental trade-offs between security and performance. Bitcoin’s automated integrity necessarily comes at high costs in its performance and resource usage. Compared to existing financial IT, Satoshi made radical trade-offs in favor of security and against performance. The seemingly wasteful process of mining is the most obvious of these trade-offs, but it also makes others. Among them is that it requires high redundancy in its messaging. Mathematically provable integrity would require full broadcast between all nodes. Bitcoin can’t achieve that, but to even get anywhere close to a good approximation of it requires a very high level of redundancy. So a 1MB block takes vastly more resources than a 1MB web page, for example, because it has to be transmitted, processed and stored with such high redundancy for Bitcoin to achieve its automated integrity.”

The crucial importance of this trade-off, was seconded by Wuille:

“If we were to allow centralization of mining, we simply wouldn’t need a blockchain in the first place. We could just let a central bank sign transactions. That would allow us much bigger and faster blocks without any capacity problems. No variable block times. No wasted electricity. No need for an inflation subsidy. It would be better in every sense, except that it would involve some trust. Really, if we don’t consider centralization of mining a problem, we might as well get rid of it altogether.”

Szabo added:

“These necessary trade-offs, sacrificing performance in order to achieve the security necessary for independent and seamlessly global automated integrity, mean that Bitcoin cannot possibly come anywhere near Visa transaction-per-second numbers and maintain the automated integrity that creates its distinctive advantages versus these traditional financial systems.”

BITCOIN VERSUS BITCOIN

This leaves us with one last question. If “Bitcoin cannot possibly come anywhere near Visa transaction-per-second numbers” as decentralists claim, then what is the point of it all? Why even bother building software, investing in startups, and spend time evangelizing Bitcoin, if it inherently doesn’t scale?

The point of it all, for decentralists, lies in a classic distinction: the distinction between Bitcoin the network and bitcoin the currency.

Bitcoin the network, decentralists argue, is fundamentally designed as a settlement system, not as a network for fast and cheap payments. While maybe not the most typical decentralist himself, a recent contribution to the Bitcoin developer mailing list by Core developer Jeff Garzik perhaps explains the decentralist perspective best.

Garzik wrote:

“Bitcoin is a settlement system, by design. The process of consensus ‘settles’ upon a timeline of transactions, and this process – by design – is necessarily far from instant. … As such, the blockchain can never support All The Transactions, even if block size increases beyond 20MB. Further layers are – by design – necessary if we want to achieve the goal of a decentralized payment network capable of supporting full global traffic.”

But, importantly, this vision of Bitcoin as a limited settlement network, does not mean that bitcoin the currency cannot flourish beyond these built-in limits.

As explained by Szabo:

“When it comes to small-b bitcoin, the currency, there is nothing impossible about paying retail with bitcoin the way you’d pay with a fiat currency – bitcoin-denominated credit and debit cards, for example, with all the chargeback and transactions-per-second capabilities of a credit or debit card. And there are clever trust-minimizing ways to do retail payments in the works. Capital-B Bitcoin, the blockchain, is going to evolve into a high-value settlement layer, and we will see other layers being used for small-b bitcoin retail transactions.”

Or as Garzik elaborated:

“Bitcoin payments are like IP packets – one way, irreversible. The world’s citizens en masse will not speak to each other with bitcoin (IP packets), but rather with multiple layers (HTTP/TCP/IP) that enable safe and secure value transfer or added features such as instant transactions.”

Moreover, decentralists contend that even these upper layers could include most of the advantages that the Bitcoin network introduced. Once fully developed, technological innovations such as the Lightning Network and tree-chains should allow users to transact in a decentralized, trustless, and even instant fashion – while ultimately settling on the Bitcoin blockchain. While it is true that on-chain transactions will cost more as room in blocks becomes scarce, decentralists maintain that it is the only way to keep that chain decentralized and trustless – and that that does not need to be a problem.

“Yes, on-chain transaction fees will rise,” Todd acknowledged. “But that changes what you use Bitcoin’s underlying blockchain layer for, and how often – not whether or not you can transact at all. A world where you can send anyone on the planet money directly on the blockchain for five dollars – or for near zero via caching techniques like Lightning – is a very good option, and it will buy us time to develop techniques to make blockchains themselves scalable …”

1.5. IRC log 2012-04-04

1333560356|1|wumpus|for errors that are fatal or really require the users long term attention 1333560364|1|BlueMatt|heh, yet another request for sending double spend notifications... 1333560366|1|BlueMatt|wow... 1333560405|1|gavinandresen|while we're cleaning up code... wxAnything aught to be renamed 1333560413|1|jgarzik|heh 1333560441|1|wumpus|gavinandresen: yes 1333560554|1|lh77|What is mintchip? 1333560562|1|dvide|the best ice cream flavour 1333560565|128|erle-|Quit: erle- 1333560581|1|Graet|its the evolution of currency. 1333560588|1|BlueMatt|heh 1333560590|1|Graet|http://mintchipchallenge.com/ 1333560592|1|Graet|:P 1333560598|1|lh77|is it like bitcoin? 1333560600|1|lh77|peer to peer? 1333560604|1|Graet|not at all 1333560612|1|lh77|what does it do exactly? 1333560615|1|Graet|mint = canadian mint 1333560620|1|Graet|read link? 1333560626|1|Graet|i'm going bed :) 1333560638|32|Joric_|#bitcoin-dev 1333560638|128|Joric_|Changing host 1333560638|32|Joric_|#bitcoin-dev 1333560702|128|coingenuity|Read error: Connection reset by peer 1333560710|1|freewil|well one thing mintchip has that bitcoin doesnt is a large organization behind it 1333560724|128|Joric|Ping timeout: 246 seconds 1333560740|1|Diablo-D3|no one has even proven its from the canadian mint 1333560741|1|Diablo-D3|also 1333560745|1|Diablo-D3|its not distributed nor secure 1333560760|1|Diablo-D3|its DRMed virtual money using a central source to issue keys 1333560762|1|BlueMatt|wait, do I agree with Diablo-D3 for once? 1333560776|1|wumpus|that bitcoin has no large organization behind it is a good thing imo 1333560776|1|BlueMatt|damn im getting cynical 1333560783|128|barmstro_|Remote host closed the connection 1333560813|1|Blitzboom|no it’s not 1333560819|1|gavinandresen|awww.... we don't get no respect, BTC isn't one of the currency codes supported by MintChip 1333560820|8|Joric_|Joric 1333560833|1|Blitzboom|it would be good to have funding for developmenta, PR and legal matters 1333560844|1|wumpus|bitcoin is neutral, which is a good thing, and the only way it can work 1333560863|1|gavinandresen|PR is lovebitcoins.org 1333560866|1|wumpus|if it was controlled by an organisation it'd just be another virtual object type 1333560874|1|wumpus|and I would have zero interest in it 1333560893|1|freewil|im just talking about a non-profit to fund development 1333560901|1|gavinandresen|I'm talking with somebody tomorrow about a non-profit for legal stuff about bitcoin 1333560925|1|freewil|gavinandresen, what about paying you to develop full time :) 1333560942|1|wumpus|that's good, as long as it doesn't become a central point of failure 1333560948|1|BlueMatt|gavinandresen pretty much does develop full-time 1333560954|1|gavinandresen|freewil: feel free. TruCoin was paying me until their funding dried up... 1333560955|1|BlueMatt|(and we should pay him) 1333561003|1|gavinandresen|There are several workable models for funding open source projects, if I was more of a business person I'd spend more time thinking about which one makes sense for bitcoin 1333561040|1|freewil|the only ones i really know are donations and support-based revenue 1333561051|1|Blitzboom|satoshi should simply throw in a few hundred k BTC 1333561069|1|gavinandresen|throw in... where ? 1333561080|1|Graet|the "kitty" 1333561081|1|wumpus|in gavinandresens account 1333561094|1|Blitzboom|that non-profit’s bank 1333561140|128|Diapolo|Quit: Page closed 1333561143|1|Blitzboom|yeah, donations should work. there are plenty of large holders who have a healthy interest in it 1333561183|1|BlueMatt|luckily we are a "currency" 1333561192|1|BlueMatt|getting eg mtgox to donate a bit wouldnt be hard 1333561243|1|denisx|isnt deepbit the biggest profitmaker? 1333561248|1|wumpus|support-based sounds interesting, maybe we should add a payment to open issues :-) 1333561258|128|mmoya|Ping timeout: 244 seconds 1333561281|1|Joric|what do you think about blocking mtgox accounts due to 'tainted' coins? that bitcoin AIDS is making me nervous 1333561300|1|BlueMatt|Joric: welcome to the world of finance regulation 1333561306|32|[Tycho]|#bitcoin-dev 1333561321|1|wumpus|well mtgox can decide what they do for themselves right? 1333561340|1|Joric|it's the biggest exchange atm 1333561356|1|Joric|most coins end there 1333561389|1|BlueMatt|wumpus: sort of, though bitcoin isnt technically regulated as a currency, they still have to try to regulate it as if it were to avoid aml issues 1333561421|1|wumpus|BlueMatt: yes, that's the problem with it being so easy to trace 1333561455|1|jgarzik|bitcoin AIDS? 1333561464|1|wumpus|though a global ledger is probably the only way a distributed currency can work 1333561477|1|jgarzik|does mtgox have a list of tainted coins? 1333561482|1|wumpus|yes 1333561491|1|wumpus|they have a naughty list 1333561502|32|barmstrong|#bitcoin-dev 1333561588|1|wumpus|I think the bigger problem is not mtgox specifically but that bitcoin is so dependent on a few exchanges, they are centralized bottlenecks

1.6. Pieter Wuille On neutrality

This is hard to answer, as "blockchain" isn’t a very well defined thing. Often the term refers to some use of cryptography in a distributed system, but what it means beyond that depends on who you ask. To those who use it as a generic term, it is usually little more than a marketing term.

If you assume that at least there is an actual chain of blocks being built, either by a permissionless set of participants based on economic incentive ("miners"), or by a permissioned set of signers with long-term identities, the question you’re asking actually does not make sense. Blockchain consensus algorithms do not compete with or replace databases as such. They are a mechanism for obtaining consensus on a global state, where multiple participants have authority to accept changes. Arguably, each of those participants already needs a database themselves - the blockchain is merely a log of all accepted updates to those databases. Even in Bitcoin, every node actually has a local database with the UTXO set. In Bitcoin Core, that is a LevelDB database, but there is no fundamental reason why another database couldn’t be used.

Of course, in some scenarios all you need is a single authority deciding on all changes to the database. In that case a database is indeed all you need. But that’s a silly comparison: there are plenty of use cases for distributed systems with multiple writers today, in production use, that have no relation with blockchains. Look up Paxos, or Google Spanner for example. The complexity is not in the database part, but in keeping the participants synchronized. That is what a consensus algorithm does. Most production instances I know of this use mutually trusting authorities (and a distributed system is used for performance/latency reasons rather than trust), but algorithms that permit distrusting participants are well known as well, e.g. PBFT.

Now, digging deeper: how does a private blockchain compare with such a system? The answer is trivial: it is effectively a new way of looking at the same thing. Private blockchains (i.e. there is a set of known identities that can approve changes) rely on running a traditional consensus algorithm (e.g. PBFT) between the block signers to make sure only a single chain emerges. Here the "blockchain" is literally the log of changes, as many of its properties (e.g. the ability to temporarily fork) aren’t even used. That log may be useful for auditing purposes, and if you structure it as a hash chain, you could indeed call it a blockchain. But there is no innovation here whatsoever. That doesn’t mean "blockchain technology" is necessecarily useless here, as some of the cryptography for e.g. transaction verification may still be applicable (depending on the use case), but, arguably, the blockchain as a datastructure itself not novel in any way here.

Things get much more interesting when you’re talking about a public blockchain (where anyone can become an authorizer of changes) but its use cases are very limited. I’m going to focus here on proof-of-work, as I don’t believe any solution that completely avoids PoW actually securely offers the same properties. What PoW does is replace the signing of blocks by known identities with betting on particular versions of history and paying for the bet. Everyone who consistently bets with the majority ("miners") gets paid, and those who diverge don’t. There are two fundamental changes here: (a) there must be something of value to pay miners, which typically implies that your blockchain needs to define its own currency, limiting the use cases to effectively just cryptocurrencies (b) you don’t get guaranteed convergence anymore, only probabilistically and under economical assumptions.

To summarize, the answer to your question really depends on what you mean by blockchain, and what kind of thing you’re comparing it to:

-

Cryptography used in blockchains may be widely applicable in a variety of settings, but doesn’t really have anything to do with blockchains or databases themselves.

-

Using consensus algorithms (private or public, including typical "blockchain based" ones) in situations where there is only a single authorizer is silly; you should use the database directly.

-

Using fault tolerant consensus algorithms (either traditional BFT like ones, or PoW) is overkill when your authorizers are trusted (e.g. because they’re all run by the same company). Use something like Paxos instead.

-

Using trustless consensus algorithms like PoW does add something no other construction gives you (permissionless participation, meaning there is no set group of participants that can censor your changes), but comes at a high cost, and its economic assumptions make it pretty much only useful for systems that define their own cryptocurrency. There is probably only place in the world for one or a few actually used ones of these.

1.7. Gregory Maxwell on autonomy

Your prior understanding sounds correct.

Many people have a hard time understanding autonomous systems, there are many in their lives things like the english language-- but people just take them for granted and don’t even think of them as systems. They’re stuck in a centralized way of thinking where everything they think of as a 'thing' has an authority that controls it.

Bitcoin doesn’t focus on anything. Various people who have adopted Bitcoin chose of their own free will to promote it, and how they choose to do so is their own business. Authority fixated people may see these activities and believe they’re some operation by the bitcoin authority, but no such authority exists.

The article might just as well say "Meanwhile, English has recently introduced 'chatspeek'-- an informal abbreviated form of the language-- to attract a younger, more mobile, generation to its platform."

2. Trustlessness

2.1. Pieter Wuille on trustlessness

The term trustless is often misunderstood. I suspect you mean not needing to trust anyone, but if a program being open source helps for that, aren’t you implicitly relying on the people who are capable of reviewing the source code to have actually done so? Isn’t that also a form of trust? Of course it is. Every production system needs to trust various aspects of the infrastructure: the hardware it’s running on, the compiler that was used, the operating system, and last but not least the human operating it.

The trust we’re talking about in "trustless" is an abstract technical term. A distributed system is called trustless when it does not require any trusted parties to function correctly. In that sense, a "trustless wallet" does not make sense: wallets are an implementation aspect of a cryptocurrency, the design of which may or may not rely on trusted parties. The wallet software being open or closed source doesn’t change this.

Does that mean you should use a closed-source wallet? Hell no. Not because it’s "trustless" or not, but because there is no chance it’ll have been sufficiently reviewed (unless, perhaps, you have access to the source code under NDA and paid for thorough review yourself).

2.3. David Harding: Full Validation, The best possible decentralized security

Imagine a scientist reading about an experimental result and then repeating the experiment for herself. Doing so allows her to trust the result without having to trust the original scientists.

Bitcoin Core checks each block of transactions it receives to ensure that everything in that block is fully valid—allowing it to trust the block without trusting the miner who created it.

This prevents miners from tricking Bitcoin Core users into accepting blocks that violate the 21 million bitcoin limit or which break other important rules.

Users of other wallets don’t get this level of security, so miners can trick them into accepting fabricated transactions or hijacked block chains.

Why take that risk if you don’t have to? Bitcoin Core provides the best possible security against dishonest miners along with additional security against other easier attacks (see below for details).

How Validation Protects Your Bitcoins

Bitcoin banks and lightweight (SPV) wallets put your bitcoins at increased risk of being stolen. That risk may be acceptable for small values of bitcoin on mobile wallets, but is it what you want for your real wallet?

Direct theft

Alice deposits 100 bitcoins to Bank.Example.com. The next day, the owners of the site disappear with Alice’s money.

-

Bitcoin bank users are vulnerable to direct theft because they don’t control their own private keys.

-

Lightweight (SPV) wallet users and Bitcoin Core users are not vulnerable because they control their own private keys.

Direct theft is likely the leading cause of stolen bitcoins so far.

Real Example

Bitcoin exchange Mt Gox reportedly had 650,000 bitcoins (worth $347 million USD) stolen from their customer deposits and their own operating funds. They declared bankruptcy on 28 February 2014.

Even when the bankruptcy proceeding is complete, customers are unlikely to recover more than a small fraction of the bitcoins they had on deposit.

Learn More: Collapse of Mt Gox

Bait and switch

Alice installs Example Wallet, whose open source code has been audited. The next day, the authors of Example Wallet push new code to Alice’s device and steal all her bitcoins.

-

Bitcoin bank users are vulnerable because they can only spend their bitcoins when they use the bank’s approved software.

-

Lightweight (SPV) wallet users are vulnerable with most software because auditors can’t easily verify the software you run (the executable) is the same as the program source code, called a deterministic build. However, some lightweight wallets are moving to deterministic builds.

-

Bitcoin Core is built deterministically. Cryptographic signatures from build auditors—many of whom are well known to the community—are released publicly.

Bitcoin.org’s Choose Your Wallet page tells you whether or not wallet builds are audited in the Transparency score for each wallet.

Real Example

In April 2013, the OzCoin mining pool was hacked. The thief stole 923 bitcoins (worth $135,000 USD), but online wallet StrongCoin modified their wallet code to ‘steal back’ 569 of those bitcoins ($83,000) from one of their users who was suspected of the theft.

Although this attack was done with good intentions, it illustrated that the operators of StrongCoin could steal bitcoins from their users at any time even though the users supposedly controlled their own private keys.

Fabricated transactions

Mallory creates a transaction giving Alice 1,000 bitcoins, so Alice gives Mallory some cash. Later Alice discovers the transaction Mallory created was fake.

-

Bitcoin bank users depend on the information reported by the bank, so they can easily be fooled into accepting fabricated transactions.

-

Lightweight (SPV) wallet users depend on full nodes and miners to validate transactions for them. It costs nothing for dishonest full nodes to send unconfirmed fabricated transactions to an SPV wallet. Getting one or more confirmations of those fabricated transactions is also possible with help from a dishonest miner.

-

Bitcoin Core users don’t have to worry about fabricated transactions because Bitcoin Core validates every transaction before displaying it.

Currently the best defense against fabricated transactions, besides using Bitcoin Core, is to wait for as many confirmations as possible.

Real Example

On 4 August 2015, web wallet BlockChain.info began indicating that a transaction had spent the earliest mined 250 bitcoins, coins that some people believed were owned by Bitcoin creator Satoshi Nakamoto.

It was soon discovered that the transaction was invalid. BlockChain.info was not validating transactions with Bitcoin Core and that transaction had been created by a security researcher.

Chain hijacking

Alice believes that there should never be more than 21 million bitcoins—but one day she’s tricked into buying “bitcoins” that are only valid on a block chain with permanent 10% inflation.

-

Bitcoin bank users have to use whatever block chain the bank uses. Banks can even profit from switching their users to a new chain and selling their users’ bitcoins from the old chain.

-

Lightweight (SPV) wallet users accept the block chain they know about with the most proof of work. This lets the hash rate majority of miners force SPV wallet users off of Bitcoin.

-

Bitcoin Core users don’t have to worry about chain hijacking because Bitcoin Core validates every block using all of Bitcoin’s consensus rules.

Preventing chain hijacking is one of Bitcoin Core’s most important jobs. The alternative is to allow miners to do whatever they want.

Real Example

In July 2015, several large Bitcoin miners accidentally produced an invalid block chain several blocks longer than the correct block chain. Some bank wallets and many SPV wallets accepted this longer chain, putting their users’ bitcoins at risk.

Recent versions of Bitcoin Core never accepted any of the blocks from the invalid chain and never put any bitcoins at risk.

It is believed that the miners at fault controlled more than 50% of the network hash rate, so they could have continued to fool SPV wallets indefinitely. It was only their desire to remain compatible with Bitcoin Core users that forced them to abandon over $37,500 USD worth of mining income.

Learn more: July 2015 chain forks

Transaction withholding

Mallory shows Alice $1,000 USD that he will pay her if she sends him some bitcoins. Alice sends the bitcoins but the transaction never seems to confirm. After waiting a long time, Alice returns Mallory’s cash. It turns out the transaction did confirm, so Alice gave away her bitcoins for nothing.

-

Bitcoin bank users only see the transactions the bank choose to show them.

-

Lightweight (SPV) wallets users only see the transactions their full node peers choose to send them, even if those transactions were included in a block the SPV wallet knows about.

-

Bitcoin Core users see all transactions included in received blocks. If Bitcoin Core hasn’t received a block for too long, it displays a catching-up progress bar in the graphical user interface or a warning message in the CLI/API user interface.

Unless you use Bitcoin Core, you can never be sure that your bitcoin balance is correct according to the block chain.

Chain rewrites

Mallory gives Alice 1,000 bitcoins. When Alice’s wallet says the transaction is confirmed, Alice gives Mallory some cash. Later Alice discovers that Mallory has managed to steal back the bitcoins.

This attack applies to all Bitcoin wallets.

The attack works because powerful miners have the ability to rewrite the block chain and replace their own transactions, allowing them to take back previous payments.

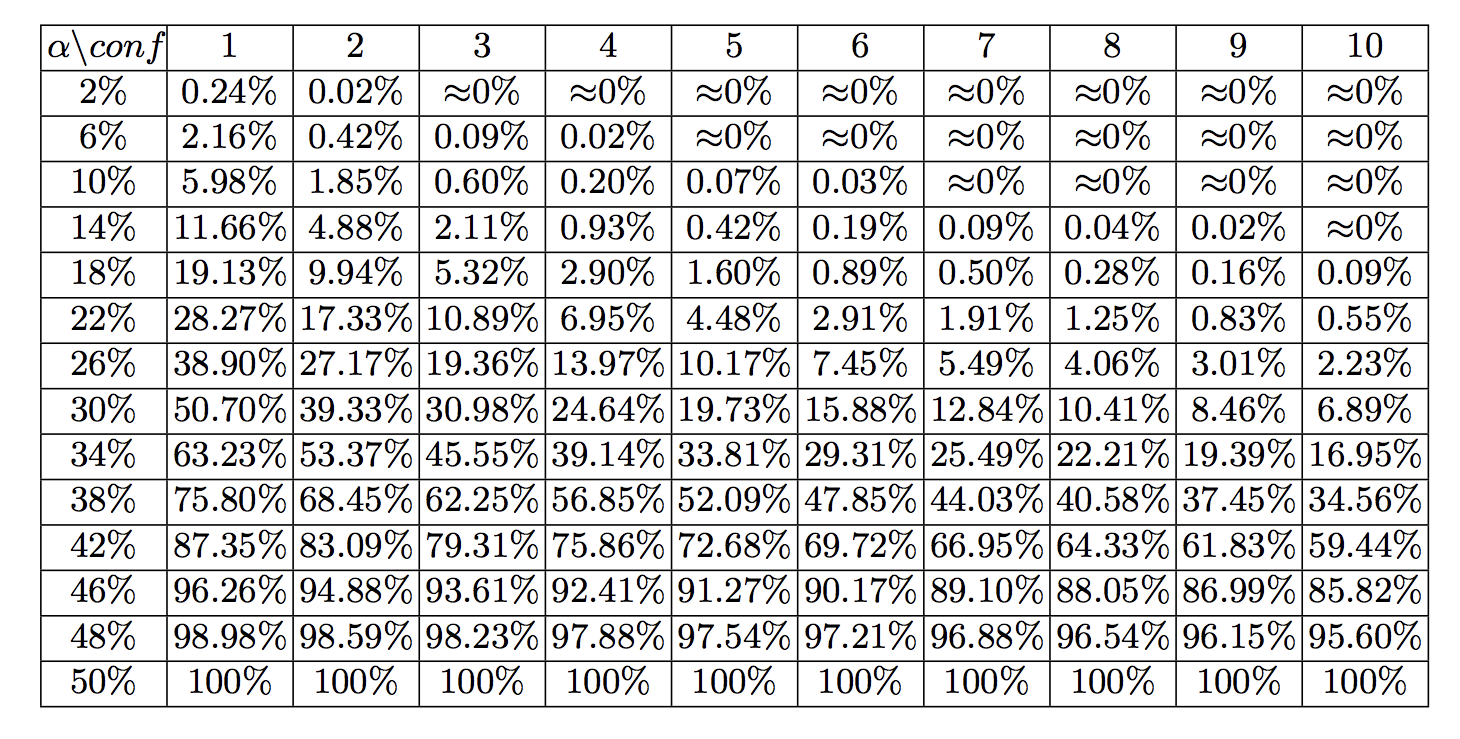

The cost of this attack depends on the percentage of total network hash rate the attacking miner controls. The more centralized mining becomes, the less expensive the attack for a powerful miner.

Real Example

In September 2013, someone used centralized mining pool GHash.io to steal an estimated 1,000 bitcoins (worth $124,000 USD) from the gambling site BetCoin.

The attacker would spend bitcoins to make a bet. If he won, he would confirm the transaction. If he lost, he would create a transaction returning the bitcoins to himself and confirm that, invalidating the transaction that lost the bet.

By doing so, he gained bitcoins from his winning bets without losing bitcoins on his losing bets.

Although this attack was performed on unconfirmed transactions, the attacker had enough hash rate (about 30%) to have profited from attacking transactions with one, two, or even more confirmations.

Note that although all programs—including Bitcoin Core—are vulnerable to chain rewrites, Bitcoin provides a defense mechanism: the more confirmations your transactions have, the safer you are. There is no known decentralized defense better than that.

Help Protect Decentralization

The bitcoin currency only works when people accept bitcoins in exchange for other valuable things. That means it’s the people accepting bitcoins who give it value and who get to decide how Bitcoin should work.

When you accept bitcoins, you have the power to enforce Bitcoin’s rules, such as preventing confiscation of any person’s bitcoins without access to that person’s private keys.

Unfortunately, many users outsource their enforcement power. This leaves Bitcoin’s decentralization in a weakened state where a handful of miners can collude with a handful of banks and free services to change Bitcoin’s rules for all those non-verifying users who outsourced their power.

Users of Bitcoin banks |

Users of P2P lightweight wallets |

Users of client lightweight wallets |

Users of Bitcoin Core |

Unlike other wallets, Bitcoin Core does enforce the rules—so if the miners and banks change the rules for their non-verifying users, those users will be unable to pay full validation Bitcoin Core users like you.

As long as there are many non-verifying users who want to be able to pay Bitcoin Core users, miners and others know they can’t effectively change Bitcoin’s rules.

But what if not enough non-verifying users care about paying Bitcoin Core users? Then it becomes easy for miners and banks to take control of Bitcoin, likely bringing to an end this 13 year experiment in decentralized currency.

If you think Bitcoin should remain decentralized, the best thing you can do is validate every payment you receive using your own personal full node such as Bitcoin Core.

We don’t know how many full validation users and business are needed, but it’s possible that for each person or business who validates their own transactions, Bitcoin can remain decentralized even if there are ten or a hundred other non-verifying users. If this is the case, your small contribution can have a large impact towards keeping Bitcoin decentralized.

Do You Validate Your Transactions?

Some people confuse supporting the network with helping to protect Bitcoin’s decentralization.

To improve your security and help protect decentralization, you must use a wallet that fully validates received transactions. There are three ways to do that with Bitcoin Core right now:

-

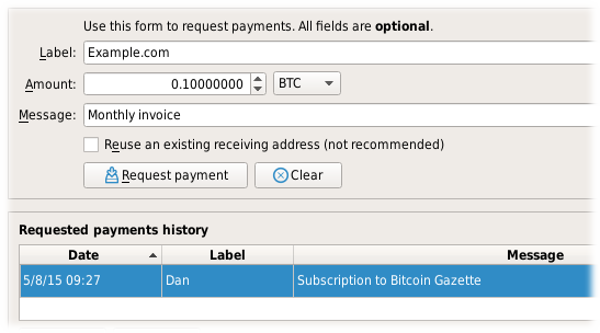

Use the built-in wallet’s graphical mode. If you request payment using the following screen in Bitcoin Core, your received transactions will be fully validated.

-

Use Bitcoin Core as a trusted peer for certain lightweight wallets. Learn more on the user interface page. If you use a secure connection to your personal trusted peer every time you use the wallet, your received transactions will be fully validated.

-

Use the built-in wallet’s CLI/API interface. This is meant for power users, businesses, and programmers. The user interface page provides an overview, the installation instructions can help you get started, and the RPCdocumentation can help you find specific commands. If you’re using

getnewaddressto create receiving addresses, your received transactions will be fully validated.

2.4. Corallo on trustlessness

… Is everyone awake? Sure. Jumping jacks. Wow, that’s bright. I am more idealistic than Eric. I am going to talk about utility and why people use bitcoin and let’s see how that goes.

Trustlessness is much better than decentralization. I want to talk about trustlessness. People use the word decentralization a lot and I find that to be kind of useless because decentralization is a means to an end. We use bitcoin because we don’t want to trust a third party, and decentralization is a fuzzy word but trustlessness you can assign some meaning to this. There was a piece on linkedin that was a history of ecash and where bitcoin came out of from the community in the 80s and 90s and it clearly birthed bitcoin. He talks a lot about various attempts at building ecash systems and why they all failed, and at the end of the day you had to trust someone. There’s a lot of different forms of that- trusting someone to continue to exist and stay in business, to not seize your coins or whatever. They all failed for those reasons. In Eric’s posting of the original satoshi announcement, you saw that you didn’t have to trust anyone. It was at least a two sentence blurb. Let’s talk about what forms this trustlessness takes in bitcoin. Why do people care about this and how do they use bitcoin?

It’s nice to think about digital gold vs payments argument; I think this is useless for evaluating cryptocurrency, but it’s interesting to loo kat that for what it implies for trusting or why you care about bitcoin. There’s a digital gold aspect of secure settlement where you want to only trust your own node, you want to verify the chain hopefully without inflation, and you get this nice property that you can run your own node and verify the rules and see on your own node the hashrate. You can see it and add it up, and calculate how much hashrate went into confirming these transactions. Maybe you wait a week, or a month, there’s various other issues with mining today. So you wait a while, you can accept transactions and say okay I know for sure without trusting anyone, a central bank, the fed, I don’t trust any of these people, or the government of Venezuela or whatever form that takes.

On the other hand, we have a payments view of trust where people are trying to avoid trusting Paypal, Visa, or someone more direct. So you are looking at bitcoin from the lense of wanting faster payments, you care about not necessarily waiting a week… where the entire modern financial system is built on the idea of coming together nad having trust around Visa or whatever. If Visa says you have paid a dollar then that’s the case. Some people might not want this- maybe you’re censored because you’re a marijuana grower in the US or various other places in the world… maybe you’re in a place where Visa doesn’t work or wherever it is. You want to be able to use bitcoin without necessarily trusting someone like that.

There’s this interesting concept that comes up. There’s this wonderful bitcoin system, hashrate you can see, you can see transactions coming through. But is that enough? Ultimately, people like to use bitcoin for more than just “well I can see a transaction and if it confirms that’s great”- they care about not being censored, about censorship resistance and getting their transactions through hopefully without trusting anyone else. Where do we get this property from?

This is where the decentralization ubzzword comes in. I refer to the concept of consensus-group distribution.. It’s useful to talk about consensus group distribution because it applies not just to proof-of-work and proof-of-stake but other systems. Your system has people putting transactions into blocks. At bitcoin, we have an attempt at consensus group distribution with hashrate and hopefully it’s decentralized and it’s really not today– that’s a huge open question; can we build a system that is in the long-term censorship resistant? It’s unclear. There have been othe rattempts like proof-of-stake and it turns out that stake and wealth has always been incredibly centralized throughout human history. There are also other untested proposals. Bitcoin is still very experimental, as well. Can we build this censorship resistant system that people want?

Also, this comes back to community norms. Why does bitcoin today actually work and have censorship resistance if mining is so centralized? Turns out, that’s community norms. People use bitcoin for censorship resistance, and if miners started aggressively violating that, then bitcoin would have less value, and miners would have less value in their investment. There’s an expectation in the community and this has played a useful role in creaitng censorship resistance. I would argue this is only temporary. If you have the next generation of miners or government, eventually people are going to find pressure points and figure out how to violate censorship resistance and try to censor payments and transactions as government are want to do.

There’s an extension to this community norms concept– in bitcoin we talk about not wanting to trust anyone, but a clear violation of this is when the rules change out from undre you. This was the old 2x fork drama. Who should I have to trust to use bitcoin for the rules to change? I would argue bitcoin applied this new community norm and really grew out of it; this is where the fork happened. You had one part of the community that wanted different norms to change the rules more aggressively, and another part of the community that didn’t want to change rules without broad agreement. This has interestingly resulted in bitcoin being unique that there’s a norm that changes don’t get made easily. Because that is the expectation of bitcoin users, and people expect this to be a thing they rely on for them to continue using bitcoin; it becomes self-perpuating because the community expects it and you thus have this nice property where you don’t have to trust bitcoin for the rules. Other projects are more about the community and who is going to enforce these rules and enforce changes.

Who’s the tech guy in here?

What implications do these concepts of various types of not wanting to trust someone have on scalability and how we look to the future? Blockchains don’t scale. If anyone tells you that they have a blockchain that scales, they are lying to your face. They might be leaving out some tradeoffs they have made. There are a lot of different areas in this overarching concept of not trusting anyone that we can relax and get a more trust-centric system that is more highly scalable. These are all valid approaches, but they are not the approach that bitcoin takes.

We could give up on the decentralization of the consensus group. We could be Ripple or Paypal where there’s a single entity or a small federation that confirms transactions. Of course, you probalby give up some of your cnesorship resistance, and maybe you have programmable money. This is a valid approach. You can also experiment with other ones— proof-of-stake probably lands in this category where you have relatively centralized stake and you end up with a consensus group which is more centralized and maybe they can censor transactions more, or maybe you get other security guarantees. That’s fine, that’s a valid approach.

You could give up on hte concept of self-validation where you give up on everyone running a fully-validating node. Everyone could be a SPV client where they only do partial validation or only see some part of the network, and this encompasses a lot of things, like sidechains and other things and sharding and ohters also fall under this category. If you can only see part of the network, then things could go faster. Other things could be going on that are invalid or incorrect and this might come back to bite you later. You don’t have this digital gold use case anymore because something happening elsewhere– that attempt at not trusting others, well it goes out the window because something happened and now people are posting on reddit that hey don’t accept payments for the next week while we reorg the whole chain or whatever. Again, valid approach, but that’s not bitcoin.

You could also choose to build a centralized payment channel network, something the opposite of lightning network– something focused on centralization instead. You could build a bank. If someone only cares about bitcoin because they only care about not wanting to trust the Fed, then maybe they’re fine trusting coinbase.com and they should be able to use the cryptocurrency that is great for that purpose. It’s interesting, because other systems in the cryptocurrency space make decisions about this. Ethereum has been talking about building in sharding techniques at the base layer, giving up on self-validation as a tradeoff. They are building this for all their users; you’re required to use that trust model.

In bitcoin, we try to avoid making decisions for people. As a community, we have been encouraging people more to build systems on top of bitcoin that gives up some of the trustlessness. If a user wants to build a bank, then they can. If people want to build a sidechain on top, they can. But this doesn’t infect everyone else using the system. It’s not built in, it’s not baked in, it’s not required to force it on everyone else just because the developers or whatever have decided to try that.

What about the future of bitcoin? What does that mean for going forward? Each use-case has different trust models baked in. Encourage different trust tradeoffs for different use-cases. Many interoperable systems for different uses. If people want to use an ETF, then fine. Let them hedge. Reduce usability gaps for those with “stricter” trust models. Continue setting community precedent.

We have to describe how the trust model works to bitcoin users. We want them to pick the thing most optimal to them. This is a massive open challenge in the community of bitcoiners. We should find a way to build these different systems and allow users to use what they want.

We should also try to focus a little bit on the usability gaps between different trust models— centralized websites are going to be infinitely more user-friendly. We should try to reduce those differences when we can. Coinbase.com is always going to be more user friendly, and it’s always more user-friendly to have a trusted system than a completely trustless system. People who want to use bitcoin without trusting others should not be discouraged from doing so simply because the usability might be terrible. You can’t change the rules out from under me. You shouldn’t do that.

2.5. brianddk - Bitcoin v22.0 and Guix; Stronger defense against the "Trusting Trust Attack"

TLDR; Bitcoin v22.0 moves to Guix so that we can "trust the compiler" even less

<tinfoil_hat_fud>

With any software that handles finance or private keys, the question of trust is important. Most have a general concept of this stuff, and that is usually fine for most anyone’s needs. But there is always the rare case where trust policies are too laxed and users get burned, like the Electrum v3.3.3 phishing attack. Here I’ll try to go through the minimal level of trust all the way down to the theoretical limit of what can be done. At the heart of the matter is the concept of extended trust. In most trust-tests, we start with something that has more trust and see if we can connect it to something with less trust. I’ll walk through a few examples from the top down. In general we will go through the following levels:

-

Trust the site

-

Trust the builders

-

Trust the compiler

-

Trust the kernel

-

Trust the hardware

Trusting the site

When downloading software such as bitcoin-core, at a minimum it is

important to ensure you download from bitcoin.org and not some site

like download.com. If you grab software from a sketchy site, it may

come packaged with code to steal your keys (See "Electrum phishing"

above).

In the realm of "trusting the site" there are those who trust the

browser to get you to bitcoin.org and others who are more paranoid

and will ensure that SSL is enforced. Unfortunately, unless the site

uses something like DNSSEC, DANE, or other cryptographic domain

verification, you can just never be sure. Attacks like bitsquatting and

dns-poisoning can get past even the best intentions of DNS security.

So… sites can’t be trusted.

Trusting the builders

In most cases, trusting the builders is the what most recommend. This

process completely ignores WHERE the binaries were taken from (even

download.com) and instead rely on a builder’s cryptographic

signature delivered with, or embedded in, the file. These are usually

either GPG signatures or CodeSigning certificates like Authenticode.

Main issues here is that many user’s don’t know WHO the builders are. In

many cases, most simply assume that a trusted product, must have a

trusted package owner / builder. A recent example of where this went

horribly wrong was when ownership of a popular JavaScript library was

left to a randome contributor. The new owner went about

crafting

back-doors to steal bitcoin. Since JavaScript is interpretive, it was

quickly spotted, but it shows the danger of entrusting new package

builders or maintainers. Clever projects (like bitcoin) get around this

problem by having reproducible builds.

Reproducible builds are a way to design software so that many community developers can each build the software and ensure that the final installer built is identical to what other developers produce. With a very public, reproducible project like bitcoin, no single developer needs to be completely trusted. Many developers can all perform the build and attest that they produced the same file as the one the original builder digitally signed.

In most situations, those who are not developers are fine to stop here. Just insist that the software you use is open-source, well audited, reproducible, with multiple maintainers who all attest to the same verified compiled binaries. Bitcoin meets this test on all counts

Trusting the compiler

For those who may fear an evil cabal of developers, or feel their project is not audited enough, the next level down is to trust nothing but the compiler. These users will build the project from source code removing the need to trust the project builders. Many may imagine that this is the furthest down the "rabbit hole" this topic can go, but in actuality it isn’t. In a 1984 award speech, the recipient, Ken Thompson, posited the question "Should you trust your compiler?". He goes on to outline a method called the "Trusting Trust Attack". Since even the most paranoid users usually trust the compiler, Ken suggested the compiler is the perfect place to put your Trojan.

The basics of this attack are due to the fact that to make a new compiler binary, you generally use the last compiler binary. But what if compiler binary had malicious code to infect new binaries. This is particularly problematic since compilers building compliers goes back pretty far. Android was made with Linux that was made from Minix. Apple was made with BSD and BSD was made from Unix. These build genealogies go back decades. So what if the original Unix back in the 60’s had a trojan in the compiler that has been carried forward for the last 60 years?

As involved as this sounds, there have been many proof of concepts done to prove the attack’s viability. And with distrust of state security agencies getting worse year after year, it’s not hard to imagine that some agency would want to pull off such attack. The main attack "surface" here are what builders call the "seed binaries". These are the previous versions of compiler and tools needed to build the next compiler. If you can "seed" your build with a smaller set of binaries then, in theory, you may get the set so small that examination, byte for byte, could look for "bad code".

In version 22.0, bitcoin moved to the Guix build system for their official builds. This reduced the "weight" of those seed binaries from 550 MB down to 120 MB. The Guix team is prototyping a new compiler build with a reduced seed weight of 357 bytes. That’s a reduction of 99.999935% from the binary seed weight of Bitcoin v0.21.2

This claim is a bit hyperbolic, but less than you might think. The

complier build requires a proto-complier (mes) and a shell (guile). This

reduction is only for mes not guile. Though there is work to do

the same reduction on guile that was done on mes, but that may

still be a few years out.

Trusting the Kernel

Implicit in the trust of the compiler is the trust of the kernel and OS that the compiler is running on. So if a trusting-trust trojan decided to propagate and infect in both a compiler and kernel, then reducing your binary seed may not be enough. This is a harder attack to pull off since a 357 byte seed build will likely be hand audited for the first few iterations. The trojan would need to know to infect the process far enough along to where it wasn’t visible any more.

The solution to this is to bootstrap your compiler build, without a

kernel. This can be done up until a point. The hex assembler and macro

assembler can be loaded directly out of a legacy bootloader (think

0x7C00) and work is ongoing in in the stage0 project that helped in

the mes bootstrap. But realistically, I’m not sure how far they can

take this.

Trusting the Hardware

Imagining if you could bootstrap without the kernel, there is still the

trust of the hardware. A builder is trusting that the processor and

instruction pipeline is not doing something malicious if it detects a

compiler bootstrap is in place. Although this is pretty deep paranoia,

people are still thinking about this stuff. The reduced mes

bootstrap is working to have a x86 and arm bootstrap independent

of each other. Although one can be cross-compiled on the other, it was

thought to be better if arm software didn’t have to trust x86

hardware for a bootstrap, and vice-versa.

</tinfoil_hat_fud>

2.6. CVE-2018-17144 Full Disclosure

Full disclosure

CVE-2018-17144, a fix for which was released on September 18th in Bitcoin Core versions 0.16.3 and 0.17.0rc4, includes both a Denial of Service component and a critical inflation vulnerability. It was originally reported to several developers working on Bitcoin Core, as well as projects supporting other cryptocurrencies, including ABC and Unlimited on September 17th as a Denial of Service bug only, however we quickly determined that the issue was also an inflation vulnerability with the same root cause and fix.

In order to encourage rapid upgrades, the decision was made to immediately patch and disclose the less serious Denial of Service vulnerability, concurrently with reaching out to miners, businesses, and other affected systems while delaying publication of the full issue to give times for systems to upgrade. On September 20th a post in a public forum reported the full impact and although it was quickly retracted the claim was further circulated.

At this time we believe over half of the Bitcoin hashrate has upgraded to patched nodes. We are unaware of any attempts to exploit this vulnerability.

However, it still remains critical that affected users upgrade and apply the latest patches to ensure no possibility of large reorganizations, mining of invalid blocks, or acceptance of invalid transactions occurs.

Technical Details

In Bitcoin Core 0.14, an optimization was added (Bitcoin Core PR #9049) which avoided a costly check during initial pre-relay block validation that multiple inputs within a single transaction did not spend the same input twice which was added in 2012 (PR #443). While the UTXO-updating logic has sufficient knowledge to check that such a condition is not violated in 0.14 it only did so in a sanity check assertion and not with full error handling (it did, however, fully handle this case twice in prior to 0.8).

Thus, in Bitcoin Core 0.14.X, any attempts to double-spend a transaction output within a single transaction inside of a block will result in an assertion failure and a crash, as was originally reported.

In Bitcoin Core 0.15, as a part of a larger redesign to simplify unspent transaction output tracking and correct a resource exhaustion attack the assertion was changed subtly. Instead of asserting that the output being marked spent was previously unspent, it only asserts that it exists.

Thus, in Bitcoin Core 0.15.X, 0.16.0, 0.16.1, and 0.16.2, any attempts to double-spend a transaction output within a single transaction inside of a block where the output being spent was created in the same block, the same assertion failure will occur (as exists in the test case which was included in the 0.16.3 patch). However, if the output being double-spent was created in a previous block, an entry will still remain in the CCoin map with the DIRTY flag set and having been marked as spent, resulting in no such assertion. This could allow a miner to inflate the supply of Bitcoin as they would be then able to claim the value being spent twice.

Timeline

Timeline for September 17, 2018: (all times UTC)

-

14:57 anonymous reporter reports crash bug to: Pieter Wuille, Greg Maxwell, Wladimir Van Der Laan of Bitcoin Core, deadalnix of Bitcoin ABC, and sickpig of Bitcoin Unlimited.

-

15:15 Greg Maxwell shares the original report with Cory Fields, Suhas Daftuar, Alex Morcos and Matt Corallo

-

17:47 Matt Corallo identifies inflation bug

-

19:15 Matt Corallo first tries to reach slushpool CEO to have a line of communication open to apply a patch quickly

-

19:29 Greg Maxwell timestamps the hash of a test-case which demonstrates the inflation vulnerability (a47344b7dceddff6c6cc1c7e97f1588d99e6dba706011b6ccc2e615b88fe4350)

-

20:15 John Newbery and James O’Beirne are informed of the vulnerability so they can assist in alerting companies to a pending patch for a DoS vulnerability

-

20:30 Matt Corallo speaks with slushpool CTO and CEO and shares patch with disclosure of the Denial of Service

-

20:48 slushpool confirmed upgraded

-

21:08 Alert was sent to Bitcoin ABC that a patch will be posted publicly by 22:00

-

21:30 (approx) Responded to original reporter with an acknowledgment

-

21:57 Bitcoin Core PR 14247 published with patch and test demonstrating the Denial of Service bug

-

21:58 Bitcoin ABC publishes their patch

-

22:07 Advisory email with link to Bitcoin Core PR and patch goes out to Optech members, among others

-

23:21 Bitcoin Core version 0.17.0rc4 tagged

September 18, 2018:

-

00:24 Bitcoin Core version 0.16.3 tagged

-

20:44 Bitcoin Core release binaries and release announcements were available

-

21:47 Bitcointalk and reddit have public banners urging people to upgrade

September 19, 2018:

-

14:06 The mailing list distributes an additional message urging people to upgrade by Pieter Wuille

September 20, 2018:

-

19:50 David Jaenson independently discovered the vulnerability, and it was reported to the Bitcoin Core security contact email.

3. Privacy

3.1. Gregory Maxwell - on privacy

For those who wants complete anonymity, they can go for some altcoins supporting it. In my opinion, BTC is supposed to be used by everyone and everywhere as mainstream currency. So please stop doing things like this to push the majority away just for the sake of niche market.

2013-11-15

I can’t seem to find the link to your bank account records, mind posting them for us?

Luke is pretty much the last person you’d expect to give a crap about underground uses. But privacy is not only a consideration for them, or even primarily for them: dope dealers—or whatever you want your bogeyman to be—can buy their way to privacy even in a system which is very non-private.

Financial privacy is an essential element to fungibility in Bitcoin: if you can meaningfully distinguish one coin from another, then their fungibility is weak. If our fungibility is too weak in practice, then we cannot be decentralized: if someone important announces a list of stolen coins they won’t accept coins derived from, you must carefully check coins you accept against that list and return the ones that fail. Everyone gets stuck checking blacklists issued by various authorities because in that world we’d all not like to get stuck with bad coins. This adds friction and transactional costs and makes Bitcoin less valuable as a money.

Financial privacy is an essential criteria for the efficient operation of a free market: if you run a business, you cannot effectively set prices if your suppliers and customers can see all your transactions against your will. You cannot compete effectively if your competition is tracking your sales. Individually your informational leverage is lost in your private dealings if you don’t have privacy over your accounts: if you pay your landlord in Bitcoin without enough privacy in place, your landlord will see when you’ve received a pay raise and can hit you up for more rent.

Financial privacy is essential for personal safety: if thieves can see your spending, income, and holdings, they can use that information to target and exploit you. Without privacy malicious parties have more ability to steal your identity, snatch your large purchases off your doorstep, or impersonate businesses you transact with towards you… they can tell exactly how much to try to scam you for.

Financial privacy is essential for human dignity: no one wants the snotty barista at the coffee shop or their nosy neighbors commenting on their income or spending habits. No one wants their baby-crazy in-laws asking why they’re buying contraception (or sex toys). Your employer has no business knowing what church you donate to. Only in a perfectly enlightened discrimination free world where no one has undue authority over anyone else could we retain our dignity and make our lawful transactions freely without self-censorship if we don’t have privacy.

Most importantly, financial privacy isn’t incompatible with things like law enforcement or transparency. You can always keep records, be ordered (or volunteer) to provide them to whomever, have judges hold against your interest when you can’t produce records (as is the case today). None of this requires globally visible public records.

Globally visible public records in finance are completely unheard-of. They are undesirable and arguably intolerable. The Bitcoin whitepaper made a promise of how we could get around the visibility of the ledger with pseudonymous addresses, but the ecosystem has broken that promise in a bunch of places and we ought to fix it. Bitcoin could have coded your name or IP address into every transaction. It didn’t. The whitepaper even has a section on privacy. It’s incorrect to say that Bitcoin isn’t focused on privacy. Sufficient privacy is an essential prerequisite for a viable digital currency.

So, again, I ask—let’s see your bank records; I’m sure there is an export to CSV. Mtgox transaction dumps? Stock trading accounts. Let’s see you—even just you—post all this before you presume to say that you think that’s what the public wants forced on everyone.

3.2. Andrew Poelstra - on anonymity

I’ve been looking into Bitcoin recently and stumbled upon numerous notes how Bitcoin is not anonymous at all, or how it’s only partially anonymous and you can easily trace your funds.

So, this brings us to my question: is there any true anonymous cryptocurrencies which I can use and there will be no trace left.

I am a fairly new member to the cryptoworld, so please, keep it simple. :)

Bitcoin Stack Exchange

The short answer is no. The long answer is split into three parts, each headed by a bold word.

-

I will talk about the existing privacy tools in Bitcoin.

-

I will talk about some pie-in-the-sky theoretical crypto which would achieve full anonymity (but which can’t be done feasibly today).

-

I will talk about CryptoNote, its limitations, and feasible ways around it that could be implemented today, specifically those that have already been implemented by Monero.

Today, you can do a lot relative to stock Bitcoin in the direction of privacy. Two strategies I should mention are CoinJoin and CoinSwap.

-

CoinJoin works by effectively pasting together transactions. In Bitcoin, each transaction is a list of inputs tied (by digital signature) to a list of outputs. The transaction is valid if the total output value is less than or equal to the total input value (any difference is a “transaction fee” claimed by miners), and if every input is a valid (not already spent) output of an old transaction. CoinJoin takes transactions from two or more users, combines the input and output lists, and has both users sign the resulting transaction. The result is that the standard flow analysis idiom of “all inputs are owned by the same person” and “all outputs are owned by the same person, except maybe for a change output” is broken. CoinJoin is tricky to implement well: output values should be as uniform as possible to avoid grouping them and matching them to input values; the resulting outputs should not be spent at the same time, since this also groups them; the join should involve two distinct parties, neither of whom is some central server participating in every join. Currently there are no good tools out there which satisfy all these requirements, but there are several in development (such as DarkWallet). Keep an eye open.

-

CoinSwap does trustless mixing, even across different blockchains (as long as each has a sufficiently rich scripting system). It is too complex to summarize here, but the result is the same as if two parties switched private keys in person, except that there is no room for cheating. That is, coins are moved between parties but the blockchain does not see this and therefore chain analysis cannot link them — except to the extent that they look funny, so if there are almost no users doing this, their transactions can be linked on this fact alone. To the best of my knowledge, there are no tools which support this. I am developing a Bitcoin wallet for experimental features such as this that will support it, but it may be several months or years away.

Total anonymity, in the sense that when you spend money there is no trace of where it came from or where it’s going, is theoretically possible by using the cryptographic technique of zero-knowledge proofs. As an extreme example, you could imagine that rather than publishing blocks mapping old outputs to new ones (which is what transactions are in Bitcoin), miners published zero-knowledge proofs that they had a valid set of transactions which, in aggregate, mapped the old set of all outputs to the new set of all outputs. You could further obscure this by having the recipient choose the destination address(es) and pass different ones to every miner. That way, only the miner who gets the block (who is probably different for every block) and the recipient knows where money is going.